If you’re a low-income earner and want to save money fast, then this blog article is for you! We’ll cover how to budget your income and expenses, how to cut back on unnecessary purchases, and how to invest for long-term financial stability. This blog is your go-to spot for tips and tricks on how to save money fast on a low income – so don’t miss out!

Table of Contents

1. First Step Toward Financial Security

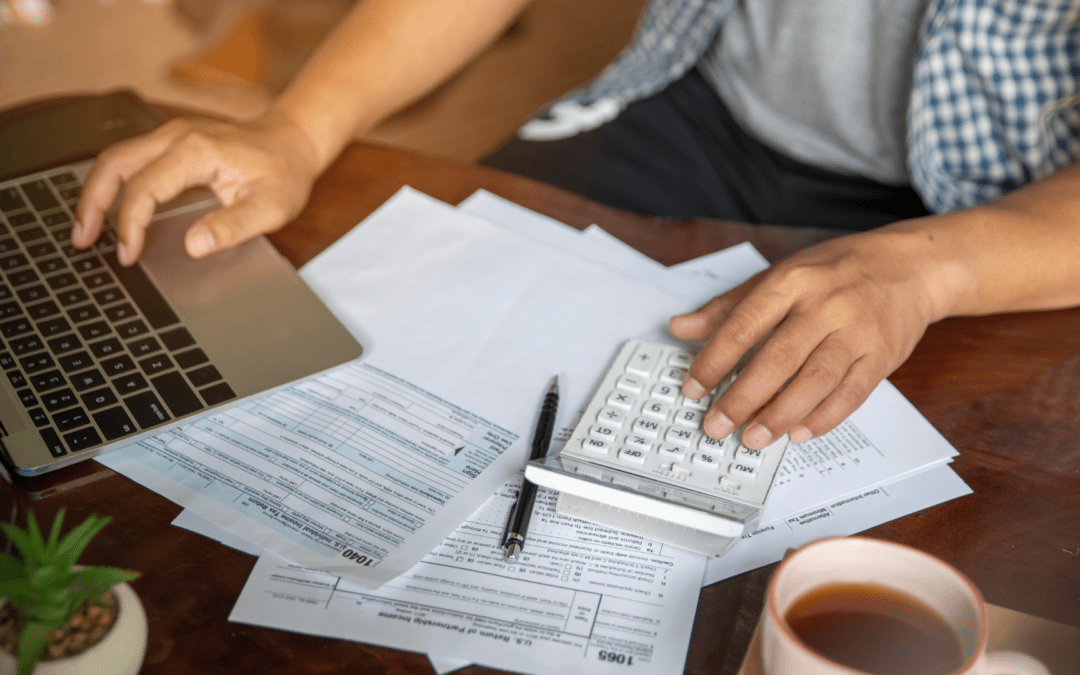

Before you can figure out how to save money fast on a low income, it’s important to have a clear understanding of where your money is going. Many people have only a general idea of their expenses, but logging everything you spend for a week or more can give you a much-needed wake-up call.

You may be surprised at how much you’re spending on things like coffee breaks, lunches, and random purchases.

Once you see where your money is going, it will be much easier to find ways to save. So take the time to track your spending, and you’ll be on your way to financial success.

2. Create a Budget

After you have tracked your expenses and understand where your money is going, it’s time to create a budget. A budget is one of the most important pieces of financial advice for anyone, but especially for those on a low income. A budget will help you track your spending, determine where your money is going, and form a plan to save money.

Without a budget, it’s all too easy to let your spending get out of control, and savings fall by the wayside. So if you’re serious about saving money fast, building a budget should be your first step. With a little time and effort, you can soon have a budget that works for you and helps you achieve your financial goals.

Learning how to budget is essential when it comes to how to save money on a low income. Once you know how to save properly and make a plan for your finances, everything else becomes easier.

3. Eliminate Costs To Save Money

It sounds easy, but when you are working with a low income, you have to ask yourself some tough questions.

- Do you need to cut your housing costs? Or maybe rent out a room to earn additional income toward your housing payment?

- How much is your car payment? Do you need to make a trade to reduce or eliminate a car payment?

- The average household spends approximately 40% of its food budget on eating out. How much are you spending on eating out? Do you need to cut back?

Whenever you’re making a purchase, always look for discounts and deals that can help you save money. There are often coupons and promo codes available for things like groceries and travel, so take advantage of them whenever possible!

4. Boost Your Income

Earning additional income while keeping your current budget will help you cushion that savings account. Consider picking up a part-time job or starting a side hustle to bring in extra cash each month. There are plenty of ways to make money on the side, from selling products online to offering your services as a freelancer. Choose something that interests you and that you think you can be successful at, and then get started!

Interested in learning what it takes to become a life insurance agent? In this article, I share how to find a high-paying job when you don’t have the experience. Learn more and see if becoming a life insurance agent is right for you.

If you are looking for high-paying jobs but don’t have a degree or experience, becoming a life insurance agent may be the perfect opportunity. We provide the training and support you need to get started in this exciting and lucrative career.

Here is more about the pros and cons of being an insurance agent.

5. Eliminate Debt

If you’re among the 45% of Americans who carry credit card debt, it’s time for a financial intervention. Credit card debt not only siphons money away from important financial goals like building an emergency fund, saving for retirement, or investing in a business but also increases your odds of sliding into poverty. The average American family carries $6,270 in credit card debt. (Source)

Every dollar counts when you’re living on a low income, so it’s important to find ways to free up as much cash as possible. One way to do that is to attack your credit card debt with a vengeance. Here are a few tips:

- Attack the debt with the highest interest rate first. This will save you the most money in the long run.

- Make more than the minimum payment each month. Even an extra $10 can make a big difference over time.

- If you can’t afford to pay off your debt all at once, consider transferring your balance to a card with 0% interest for a period of time. This will give you some breathing room while you work on paying off the debt.

- Make a budget and stick to it. This will help you free up extra money to put toward your debt each month.

- Finally, try to avoid taking on new debt while you’re working on paying off your existing debt. This will only dig you deeper into a hole that’s already getting hard to climb out of.

Credit card debt can be a serious burden, but it doesn’t have to be a life sentence. With a little planning and perseverance, you can get out from under that mountain of debt and start putting your hard-earned money towards better things.

6. Make A Long-term Savings Plan

It’s no secret that it takes more than a “rainy day fund” to be financially secure. If you want to know how to save money fast on a low income, you need to have a plan–a long-range plan for growing your savings and wealth. This may seem like common sense, but you’d be surprised how many people don’t think about their savings in this way.

By taking the time to develop a financial plan, you can set yourself up for success in the future. Not only will you have the incentive to keep saving, but you’ll also be able to put your money into different types of accounts (e.g., retirement, college savings) that can help give you and your family a more secure financial foundation. In other words, making a long-range plan for your savings is an essential step in taking control of your financial future.

Read more about taking control of your finances in this article.

In Conclusion: How to Save Money Fast on a Low Income

If you’re a low-income earner looking how to save money fast on a low income, the task can seem daunting. But with some discipline and creativity, it’s possible to get your finances in order and start building savings.

If you are ready to have freedom in life, look no further than Duff Agency. We’re here to help!